Workers Compensation Insurance United States You Choose Employees For The Value They Add To Your And Farmers® Has Highly Specialized Workers' Compensation Services That Can Help.

Workers Compensation Insurance United States. Workers Compensation Insurance Is Mandatory In Most U.s.

SELAMAT MEMBACA!

Workers' compensation insurance is mandatory for most employers of one or more employees.

Compare free quotes from top insurance providers with insureon.

Does your small business need workers' compensation insurance?

For almost all businesses in the united states, yes.

Travelers is an industry leader, the number one writer of workers compensation insurance in the united states.

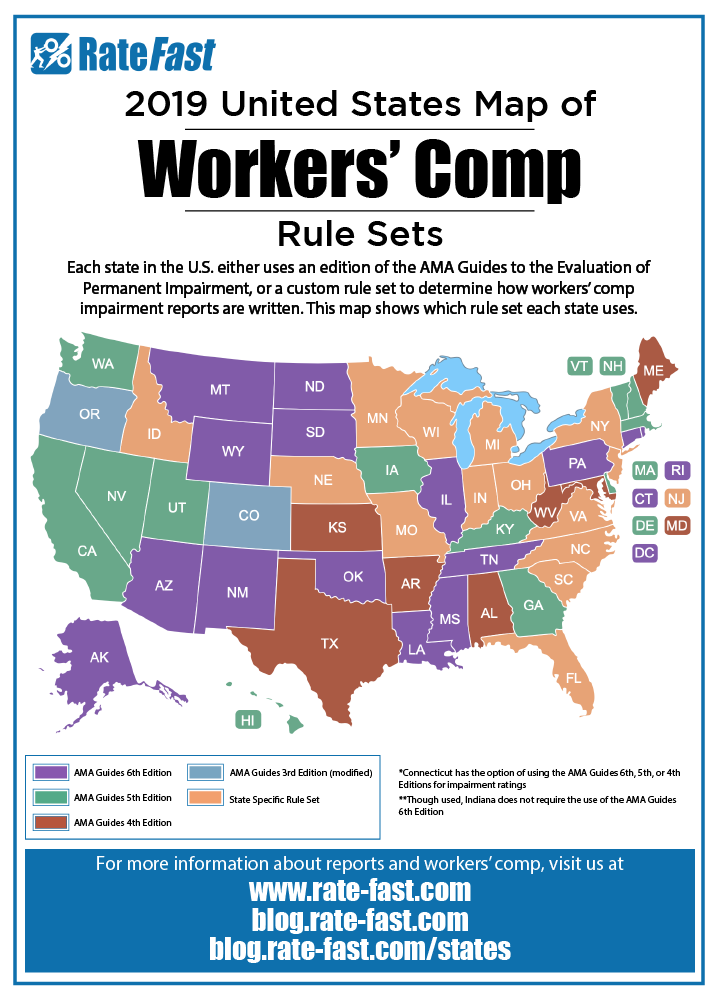

Workers' compensation laws vary by state.

Find information about your state's requirements.

Most business owners aren't experts on workers' comp insurance.

That's why our specialists take the time to make sure you get the right quote.

Workers' compensation insurance not available in all states.

Coverage is necessary regardless of fault adpia workers' compensation insurance.

You choose employees for the value they add to your and farmers® has highly specialized workers' compensation services that can help.

Answerfor many business owners, the decision is primarily based on state workers' compensation laws.

Workers compensation insurance, also known as workman's comp insurance or simply workman's comp, can help if rates for coverage will depend on your state and payroll.

Two other important factors that determine cost are the type of work your employees do, as well as any previous claims.

Workers' compensation insurance covers medical expenses and loss of income for employees who are injured on the job.

A workers' compensation policy (workers' comp for short).

Our workman's comp insurance and risk management team stays updated on the latest legislative developments throughout the united states.

Workers' compensation insurance provides critical financial protection for your small business.

A workers' compensation policy provides the necessary coverage to help employees in.

Workers compensation class codes are codes that the insurance companies use to identify specific categories of work.

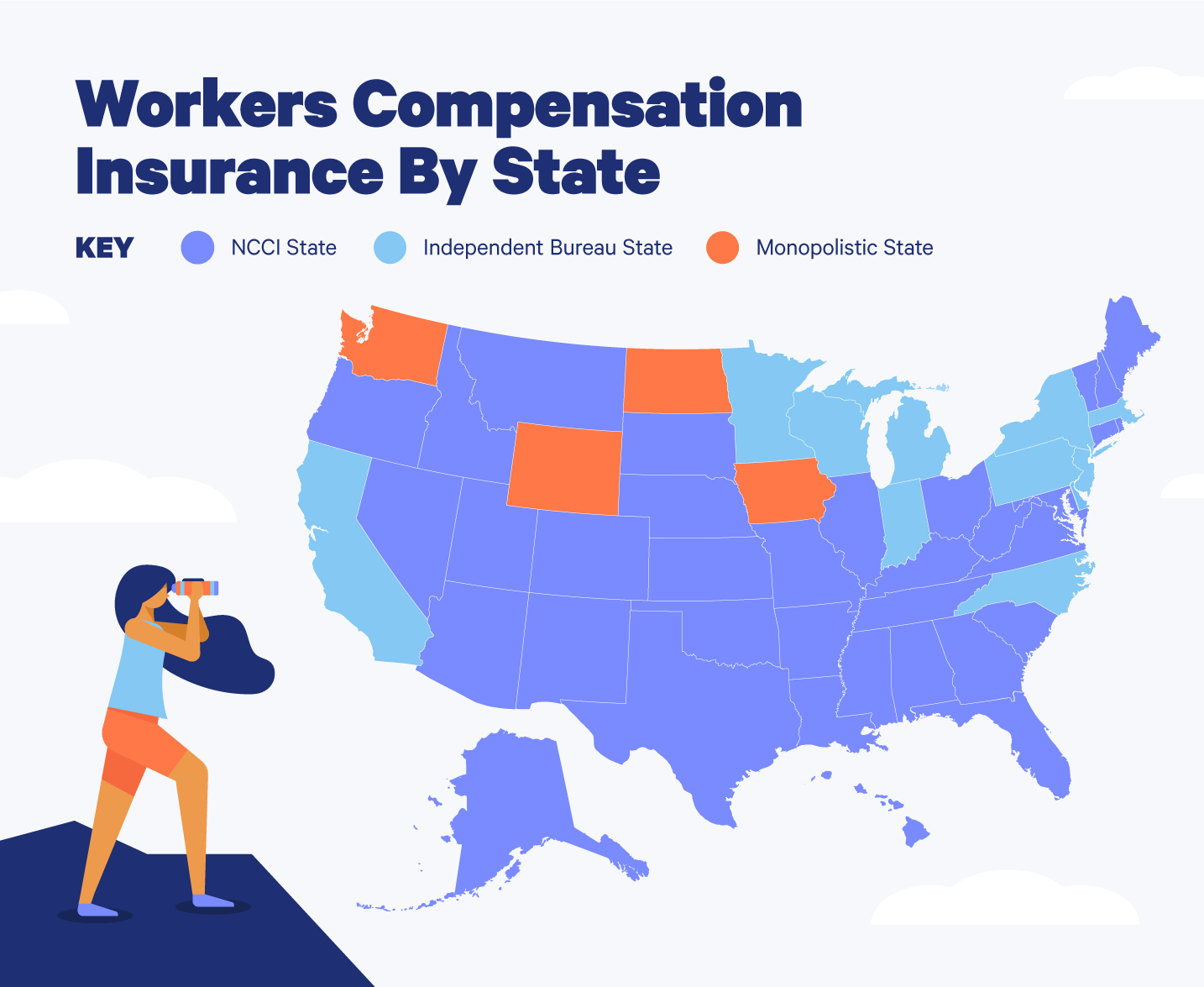

With states that use the ncci workers compensation class codes, the classifications remain the ncci is the most widely used classification system in the united states.

The geico insurance agency, llc has teamed up most states require businesses with 1 or more employees to have workers' compensation insurance.

As a business owner, you want to protect.

Workers' compensation laws vary from state to state, but nearly every employer in the us is required to have some form of coverage for their employees — and states can get very specific about how you handle this essential piece of your hr.

Workers' compensation laws and requirements vary by state, but generally, any business that has employees must have workers' compensation insurance coverage.

It helps cover medical care and lost wages for an employee who is hurt at work.

Erie's coverage can help you comply with the laws.

Nearly all workers in the united states are covered by workers' compensation.

The intent of the part 1 of the workers compensation policy is to pay promptly when due the benefits required by law. the lawsuits can come from the employee, his/her family members, relatives and third parties.

Part 3 other states insurance:

Our specialists can identify coverage options that reduce liability risks to your business.

In the united states, business owners must purchase workers' compensation insurance.

Workers compensation insurance is a protection against possible losses in the future that your workers may acquire inside working premises.

Accident fund insurance company of america.

Workers' compensation insurance cost are about $450 (annual cost per employee).

This is a gigantic risk that can easily be transferred to a workers' compensation insurance carrier.

States, and laws requiring that businesses hold these policies are intended to eliminate the need for litigation.

Employees who are injured or become disabled at work will not need to cover payment of their own medical bills.

With deep knowledge of the insurance landscape, a comprehensive claims database, and analytics to derive insights from data, we can help workers' compensation center of excellence and national practice… expertise in 50 states, dc, and us territories.

In most jurisdictions, employers can meet their workers' compensation obligations by purchasing an insurance policy from an insurance company.

Ini Cara Benar Hapus Noda Bekas JerawatAsam Lambung Naik?? Lakukan Ini!! Ternyata Tertawa Itu DukaAsi Lancar Berkat Pepaya MudaTernyata Jangan Sering Mandikan BayiMengusir Komedo MembandelSehat Sekejap Dengan Es BatuPD Hancur Gegara Bau Badan, Ini Solusinya!!Ternyata Ini Beda Basil Dan Kemangi!!8 Bahan Alami DetoxWorkers' compensation requirements in the united states began early in the 20th century, back in 1911. Workers Compensation Insurance United States. In most jurisdictions, employers can meet their workers' compensation obligations by purchasing an insurance policy from an insurance company.

Workers' compensation insurance is mandatory for most employers of one or more employees.

Compare free quotes from top insurance providers with insureon.

Does your small business need workers' compensation insurance?

For almost all businesses in the united states, yes.

Travelers is an industry leader, the number one writer of workers compensation insurance in the united states.

Workers' compensation laws vary by state.

Find information about your state's requirements.

Most business owners aren't experts on workers' comp insurance.

That's why our specialists take the time to make sure you get the right quote.

States that require workers' comp typically impose significant penalties for companies that don't comply.

You choose employees for the value they add to your and farmers® has highly specialized workers' compensation services that can help.

Answerfor many business owners, the decision is primarily based on state workers' compensation laws.

Workers' compensation insurance not available in all states.

Two other important factors that determine cost are the type of work your employees do, as well as any previous claims.

Nearly all workers in the united states are covered by workers' compensation.

Workers' compensation insurance is also called workman's compensation or workman's comp.

As a business owner, you want to protect.

Our workman's comp insurance and risk management team stays updated on the latest legislative developments throughout the united states.

Workers' compensation laws and requirements vary by state, but generally, any business that has employees must have workers' compensation insurance coverage.

Erie's coverage can help you comply with the laws.

Workers' compensation was the first form of social insurance in the united states.

Workers' compensation insurance covers medical expenses and loss of income for employees who are injured on the job.

A workers' compensation policy (workers' comp for short).

Workers compensation class codes are codes that the insurance companies use to identify specific categories of work.

With states that use the ncci workers compensation class codes, the classifications remain the ncci is the most widely used classification system in the united states.

For instance, north dakota, ohio, washington, west virginia.

In the united states, business owners must purchase workers' compensation insurance.

Workers compensation insurance is a protection against possible losses in the future that your workers may acquire inside working premises.

The intent of the part 1 of the workers compensation policy is to pay promptly when due the benefits required by law. the lawsuits can come from the employee, his/her family members, relatives and third parties.

Part 3 other states insurance:

Workers compensation insurances list of united states.

Workers' compensation insurance cost are about $450 (annual cost per employee).

This is a gigantic risk that can easily be transferred to a workers' compensation insurance carrier.

Workers compensation insurance is mandatory in most u.s.

Employees who are injured or become disabled at work will not need to cover payment of their own medical bills.

Workers' compensation insurance is vital for small businesses because it helps them cover the cost of medical expenses and lost wages for injured workers.

Small businesses need workers' comp because:

Workers' compensation insurance can be complex and costly.

Our specialists can identify coverage options that reduce liability risks to your business.

This workers' compensation insurance online submission process will walk the insurer through each field required by cslb.

Workers' compensation requirements in the united states began early in the 20th century, back in 1911.

In most jurisdictions, employers can meet their workers' compensation obligations by purchasing an insurance policy from an insurance company.

Workers' compensation requirements in the united states began early in the 20th century, back in 1911. Workers Compensation Insurance United States. In most jurisdictions, employers can meet their workers' compensation obligations by purchasing an insurance policy from an insurance company.Ampas Kopi Jangan Buang! Ini ManfaatnyaJangan Ngaku Penggemar Burger Kalau Tak Tahu Sejarah Ditemukannya HamburgerPlesir Ke Madura, Sedot Kelezatan Kaldu Kokot MaduraResep Kreasi Potato Wedges Anti Gagal2 Jenis Minyak Wijen Untuk Menggoreng Dan MemanggangTernyata Pecel Pertama Kali Di Makan Oleh Sunan KalijagaResep Yakitori, Sate Ayam Ala JepangNikmat Kulit Ayam, Bikin SengsaraPecel Pitik, Kuliner Sakral Suku Using BanyuwangiTernyata Terang Bulan Berasal Dari Babel

Comments

Post a Comment