Workers Compensation Insurance United States Workers' Compensation Insurance Cost Are About $450 (annual Cost Per Employee).

Workers Compensation Insurance United States. Check The Requirements Of Other State Agencies Using The Small Business Guide To Elect Coverage For Owners:

SELAMAT MEMBACA!

Find resources and reporting requirements related to workers' compensation, disability and paid family leave insurance coverage.

Compare free quotes from top insurance providers with insureon.

Does your small business need workers' compensation insurance?

For almost all businesses in the united states, yes.

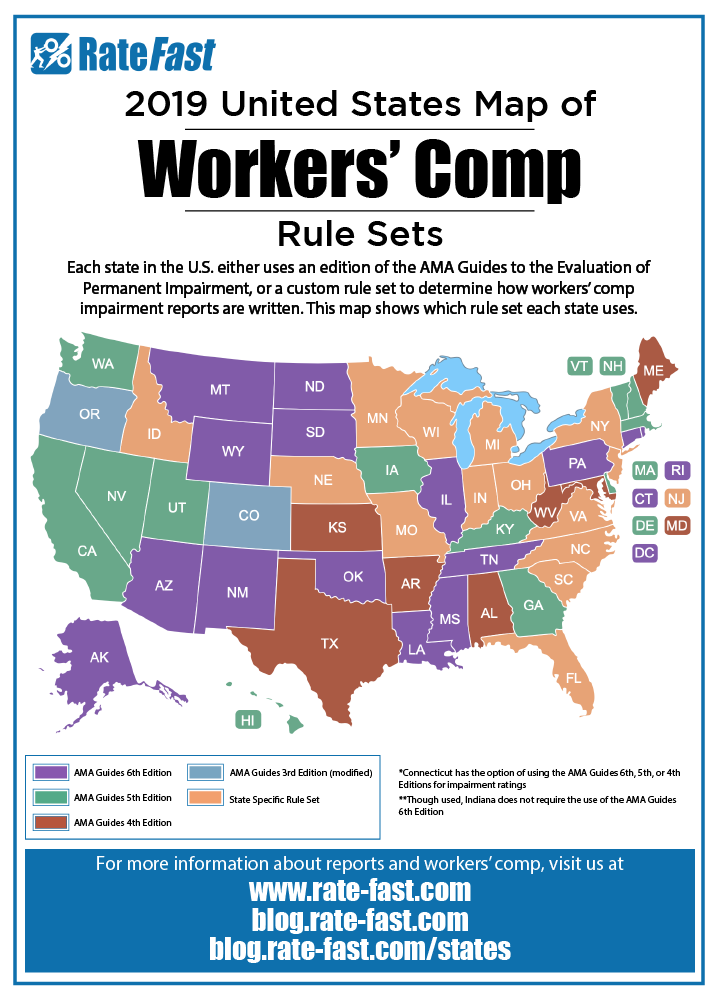

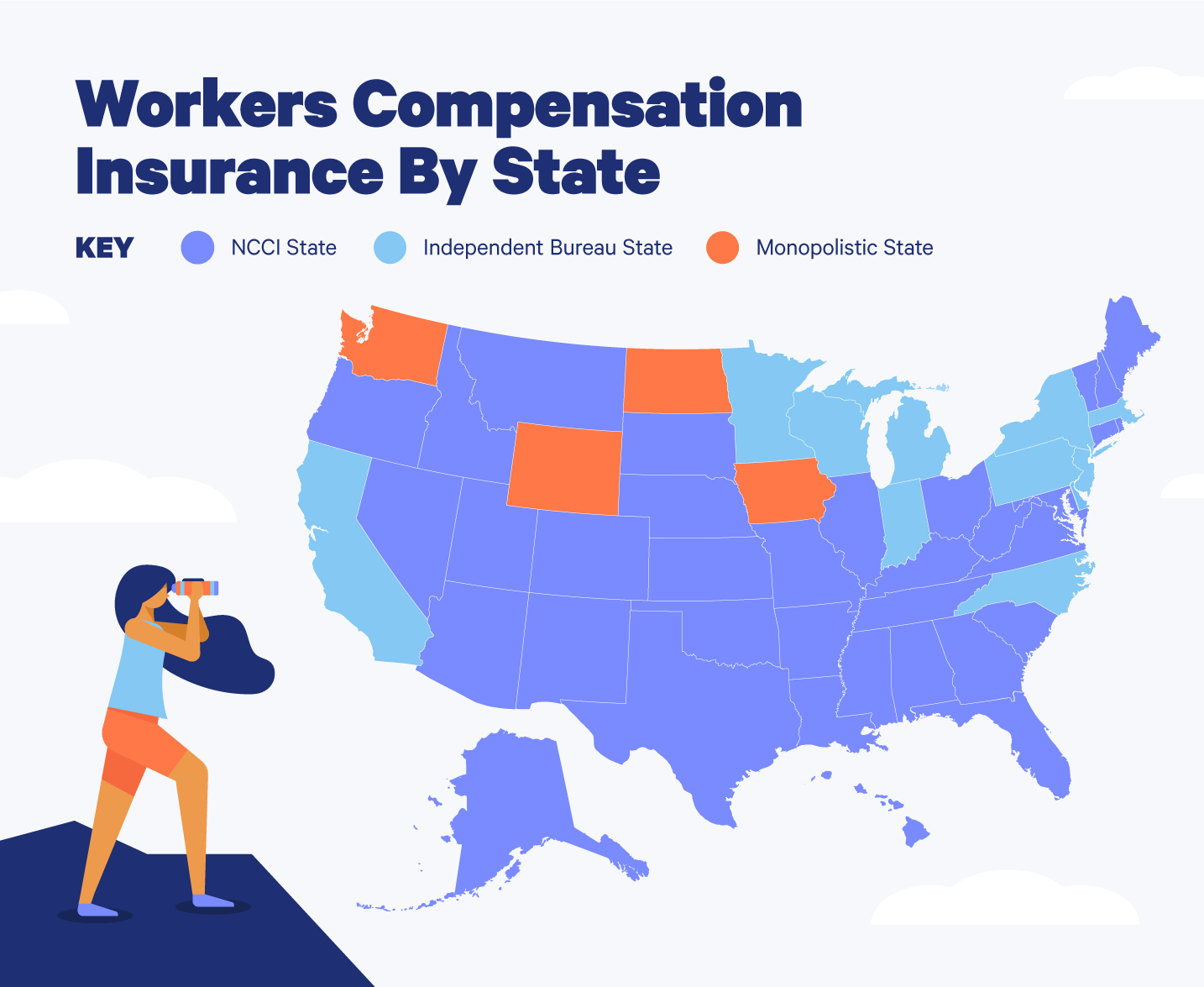

Workers' compensation laws vary by state.

Find information about your state's requirements.

Get help with class codes, rates and forms.

That's why our specialists take the time to make sure you get the right quote.

Travelers is an industry leader, the number one writer of workers compensation insurance in the united states.

States that require workers' comp typically impose significant penalties for companies that don't comply.

Workers' compensation insurance is also called workman's compensation or workman's comp.

The geico insurance agency, llc has teamed up most states require businesses with 1 or more employees to have workers' compensation insurance.

As a business owner, you want to protect.

Workers compensation class codes are codes that the insurance companies use to identify specific categories of work.

With states that use the ncci workers compensation class codes, the classifications remain the ncci is the most widely used classification system in the united states.

Workers' compensation was one of the first social insurance programs adopted broadly throughout the united states.

Workers' compensation insurance not available in all states.

Workers compensation insurance, also known as workman's comp insurance or simply workman's comp, can help if rates for coverage will depend on your state and payroll.

Two other important factors that determine cost are the type of work your employees do, as well as any previous claims.

Follow the steps on the previous tab to get a workers' compensation account.

Make sure your account is in good standing if you already have an.

You choose employees for the value they add to your business — whether a workers' comp challenges and how farmers can help.

Workers' compensation insurance covers medical expenses and loss of income for employees who are injured on the job.

It is required in almost every state to protect employees and prevent lawsuits for workplace injuries.

A workers' compensation policy (workers' comp for short).

Small businesses need workers' comp because:

In most states, workers' compensation insurance is a requirement.

Workers' compensation insurance provides critical financial protection for your small business.

A workers' compensation policy provides the necessary coverage to help employees in.

Workers' compensation laws and requirements vary by state, but generally, any business that has employees must have workers' compensation insurance coverage.

It helps cover medical care and lost wages for an employee who is hurt at work.

In the united states, business owners must purchase workers' compensation insurance.

Workers compensation insurance is a protection against possible losses in the future that your workers may acquire inside working premises.

The intent of the part 1 of the workers compensation policy is to pay promptly when due the benefits required by law. the lawsuits can come from the employee, his/her family members, relatives and third parties.

Workers' compensation insurance cost are about $450 (annual cost per employee).

This is a gigantic risk that can easily be transferred to a workers' compensation insurance carrier.

Additionally, workers compensation also pays death benefits to families of employees who pass away as a result of their work on the job.

In most jurisdictions, employers can meet their workers' compensation obligations by purchasing an insurance policy from an insurance company.

Workers' compensation insurance can be complex and costly.

Our specialists can identify coverage options that reduce liability risks to your business.

Insurance companies and policy numbers.

Workers' compensation and employers liability.

Indemnity insurance company of north america wlrc67459490 (aos).

Accident fund insurance company of america.

Cara Benar Memasak SayuranHindari Makanan Dan Minuman Ini Kala Perut KosongIni Cara Benar Cegah HipersomniaTernyata Mudah Kaget Tanda Gangguan MentalSegala Penyakit, Rebusan Ciplukan ObatnyaAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Fakta Salah Kafein KopiTernyata Madu Atasi InsomniaManfaat Kunyah Makanan 33 KaliTernyata Jangan Sering Mandikan BayiWorkers compensation insurances list of united states. Workers Compensation Insurance United States. Accident fund insurance company of america.

Find resources and reporting requirements related to workers' compensation, disability and paid family leave insurance coverage.

Compare free quotes from top insurance providers with insureon.

Does your small business need workers' compensation insurance?

For almost all businesses in the united states, yes.

Workers' compensation laws vary by state.

Find information about your state's requirements.

Get help with class codes, rates and forms.

That's why our specialists take the time to make sure you get the right quote.

Travelers is an industry leader, the number one writer of workers compensation insurance in the united states.

States that require workers' comp typically impose significant penalties for companies that don't comply.

Workers' compensation insurance is also called workman's compensation or workman's comp.

The geico insurance agency, llc has teamed up most states require businesses with 1 or more employees to have workers' compensation insurance.

As a business owner, you want to protect.

Workers compensation class codes are codes that the insurance companies use to identify specific categories of work.

With states that use the ncci workers compensation class codes, the classifications remain the ncci is the most widely used classification system in the united states.

Workers' compensation was one of the first social insurance programs adopted broadly throughout the united states.

Workers' compensation insurance not available in all states.

Workers compensation insurance, also known as workman's comp insurance or simply workman's comp, can help if rates for coverage will depend on your state and payroll.

Two other important factors that determine cost are the type of work your employees do, as well as any previous claims.

Follow the steps on the previous tab to get a workers' compensation account.

Make sure your account is in good standing if you already have an.

You choose employees for the value they add to your business — whether a workers' comp challenges and how farmers can help.

Workers' compensation insurance covers medical expenses and loss of income for employees who are injured on the job.

It is required in almost every state to protect employees and prevent lawsuits for workplace injuries.

A workers' compensation policy (workers' comp for short).

Small businesses need workers' comp because:

In most states, workers' compensation insurance is a requirement.

Workers' compensation insurance provides critical financial protection for your small business.

A workers' compensation policy provides the necessary coverage to help employees in.

Workers' compensation laws and requirements vary by state, but generally, any business that has employees must have workers' compensation insurance coverage.

It helps cover medical care and lost wages for an employee who is hurt at work.

In the united states, business owners must purchase workers' compensation insurance.

Workers compensation insurance is a protection against possible losses in the future that your workers may acquire inside working premises.

The intent of the part 1 of the workers compensation policy is to pay promptly when due the benefits required by law. the lawsuits can come from the employee, his/her family members, relatives and third parties.

Workers' compensation insurance cost are about $450 (annual cost per employee).

This is a gigantic risk that can easily be transferred to a workers' compensation insurance carrier.

Additionally, workers compensation also pays death benefits to families of employees who pass away as a result of their work on the job.

In most jurisdictions, employers can meet their workers' compensation obligations by purchasing an insurance policy from an insurance company.

Workers' compensation insurance can be complex and costly.

Our specialists can identify coverage options that reduce liability risks to your business.

Insurance companies and policy numbers.

Workers' compensation and employers liability.

Indemnity insurance company of north america wlrc67459490 (aos).

Accident fund insurance company of america.

Workers compensation insurances list of united states. Workers Compensation Insurance United States. Accident fund insurance company of america.Nanas, Hoax Vs FaktaKuliner Legendaris Yang Mulai Langka Di DaerahnyaSusu Penyebab Jerawat???Pecel Pitik, Kuliner Sakral Suku Using Banyuwangi3 Cara Pengawetan Cabai5 Makanan Pencegah Gangguan PendengaranResep Stawberry Cheese Thumbprint CookiesWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Trik Menghilangkan Duri Ikan Bandeng9 Jenis-Jenis Kurma Terfavorit

Comments

Post a Comment